Bouncing Back: How To Handle The Mortgage Reapplication Process

Was your mortgage application denied? This guide will help you navigate the mortgage application process and the ins and outs of reapplying. Learn why mortgage applications are denied, how to address those reasons, and steps to improve your application. Let’s get started.

Key Takeaways

Recovery Strategy: My Home Pathway offers personalized guidance for first-time homebuyers and those who have been denied mortgages.

Analysis Matters: When facing mortgage rejection, analyze the denial reasons carefully and develop a strategic plan to address credit issues, debt to income ratio problems, or employment concerns.

Documentation Power: Gathering complete documentation (income proof, bank statements, financial records, property details) is crucial for a successful mortgage application.

Lender Selection: Shop around for the right lender by comparing interest rates and terms from 3 to 5 different sources, and consider government-backed loans like FHA, VA, or USDA for more flexible requirements.

Mortgage Application Precision: Ensure consistency across all application documents and understand the underwriting process timeline to avoid delays when reapplying for a mortgage.

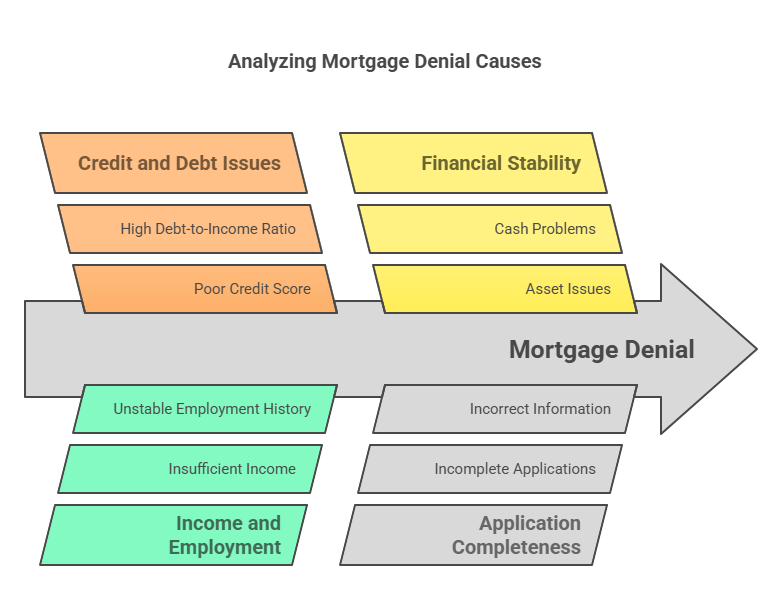

Common Reasons for Mortgage Denial

Got denied for a mortgage? Don't sweat it.

Every "no" brings you one step closer to "yes" on your homebuying journey.

Check out our post about the top 5 reasons why mortgages are denied to learn more about this.

Poor Credit Score and History: A poor credit score (typically under 620) and a history of late payments or defaults raises red flags for lenders who see you as a risky borrower. [source]

A High Debt-To-Income Ration: The debt to income (DTI) ratio is the percentage of your monthly gross monthly income that goes towards monthly debt payments. Lowering your DTI ratio demonstrates responsible financial behavior, making you a more attractive mortgage candidate. If your DTI exceeds 43%, you may face difficulties in securing a mortgage. [source]

Insufficient Income or Employment History: Lenders need to see stable employment and sufficient income, typically for at least two years, to ensure you can handle monthly mortgage payments.

Cash and Asset Problems: Insufficient down payment funds, undocumented assets, or large unexplained deposits can cause lenders to question your financial stability and reject your mortgage application.

Property Issues: Issues like low property appraisals, structural problems, or zoning violations can derail mortgage approval since the property serves as collateral.

Incomplete Applications: Applications with missing or incorrect information almost guarantee denial, so double-check all details and documentation before submission.

Incomplete applications can also lead to denial. It’s reported that one out of every five people who applied for a mortgage was denied. Accurate and complete information is important when reapplying.

Importance of Addressing Denial Reasons

Mortgage rejection stings, but treating it like a roadmap rather than a roadblock makes all the difference.

When that denial letter hits your mailbox, dig into it. Grab your free credit report and match it against what the lender flagged. Lenders don't reject mortgage applications for fun - they spot real issues you need to tackle.

Turn Rejection Into Your Action Plan

Each denial reason needs its own fix:

Credit score too low? Start paying bills on time and chip away at those balances

Debt-to-income ratio off balance? Pay down existing debts or find ways to boost your income

Employment history spotty? Stabilize your work situation before reapplying

Smart borrowers get pre-approved and learn their obstacles before falling in love with a house.

Get a Mortgage Guide in Your Corner

Flying solo through mortgage rejection feels overwhelming.

Getting expert help changes everything.

A good mortgage advisor:

Translates rejection reasons into clear action steps

Knows which lenders match your specific situation

Spots improvement opportunities you might miss

My Home Pathway provides exactly this kind of guidance, walking beside you from rejection to approval.

Explore Alternatives That Welcome You

Traditional loans shut the door? Other options swing wide open: FHA loans accept scores as low as 580 with just 3.5% down. [source]

Improving your debt-to-income ratio automatically strengthens your application. Lenders love seeing you manage money well.

Navigating today's seller's market gets even trickier after rejection, but with the right approach, you'll stand stronger on your next attempt.

Review and Correct Your Credit Report

Your credit report plays a pivotal role in the mortgage application process. It’s essential to check your credit history for any inaccuracies that could negatively impact your score.

Actions that can improve your credit score include:

Timely bill payments

Reducing debt

Avoiding new debt

Checking your credit report for errors

Disputing errors with the credit bureau can correct inaccuracies, leading to a better credit score and higher chances of mortgage approval.

Gathering Necessary Documents

The Document Foundation for Success

Lenders need proof you can handle mortgage payments long-term. That's an essential part of the mortgage process.

Your documents tell this story better than words ever could. Complete paperwork shows lenders you mean business and lets them approve your loan faster.

Missing or sloppy documents? That's how applications end up in the rejection pile.

The Must-Have Document Checklist

Proof You Make Money (Employment & Income)

Last 1-2 years of W-2 forms

Recent pay stubs (typically last 30 days)

Tax returns from previous 2 to 3 years

Run your own business? Bring:

Two years of tax returns

Year to date profit/loss statement

Business bank statements

Most lenders want to see you've held steady work for at least two years. Job hoppers face tougher approval odds.

Show Them Your Money (Banking & Assets)

Gather statements that show:

Checking/savings accounts

Investment accounts

Real estate you already own

Money from previous home sales

Gift funds (with proper documentation)

You'll also need to come clean about all debts:

Car loans

Credit cards

Student loans

Child support/alimony payments

Current mortgage or rent

Having recent statements ready speeds up the home buying process tremendously. My Home Pathway helps organize these documents efficiently.

The Property Rundown

Your application needs:

Complete property address

Agreed purchase price

Property type (single family, condo, etc.)

The lender will order an appraisal to confirm the home's worth matches what you're paying. Understanding your rights as a homebuyer helps navigate this process.

When Appraisals Throw a Curveball

Appraisal comes in low? You've got options:

Negotiate the price down with the seller

Bring more cash to close the gap

Contest the appraisal (if you have evidence)

Walk away (if your contract allows)

Low appraisals stop more deals than most realize. Smart buyers prepare for this possibility before falling in love with a property.

Document Organization Made Simple

Struggling with paperwork overload? My Home Pathway's personalized roadmap simplifies document gathering and explains exactly what you need for your unique situation.

The right documents, properly organized, transform you from a rejected applicant to an approved homeowner faster than you might think.

Choosing the Right Mortgage Lender

Getting rejected once doesn't mean you're stuck. It means you need a better partner for your homebuying journey.

Why Your Lender Choice Makes All The Difference

The right mortgage lender doesn't just approve you, they find terms that actually work for your situation.

Your mortgage relationship lasts decades, so choosing wisely now saves thousands later.

Shop Around Like Your Wallet Depends On It (Because It Does)

When comparing mortgage options:

Get quotes from 3 to 5 different lenders

Request Loan Estimates (official documents showing all costs)

Compare them all on the SAME DAY (rates change daily)

Look beyond the interest rate at closing costs and fees

Each 0.25% interest difference means roughly $25 per month per $100,000 borrowed. Those small numbers add up to thousands over your loan life!

Smart shoppers compare renting versus buying costs while looking at different loan options.

Government Loans: Your Second-Chance Lifeline

Got credit issues or limited cash? Government, backed loans often welcome borrowers traditional lenders reject:

FHA loans: Accept scores as low as 580 with just 3.5% down [source]

VA loans: Zero down payment for qualifying veterans with competitive rates

USDA loans: No down payment needed in qualifying rural areas

These programs exist specifically to help people overcome common approval obstacles.

Get A Mortgage Guide In Your Corner

Mortgage brokers access multiple lenders with one application, saving you time and potential credit hits.

When working with a broker:

Verify their credentials and reputation

Be completely honest about your financial situation

Ask how they get paid (by you or the lender)

The right broker knows which lenders accept your specific challenges.

Create Your Custom Path To Approval

My Home Pathway specializes in turning rejections into approvals through personalized guidance.

Their free support helps you:

Understand exactly why you got rejected

Create a step by step plan to fix those issues

Find lenders who specialize in your situation

Optimize your financial behaviors for better terms

Ready to transform rejection into approval? Visit My Home Pathway's getting started page for your custom roadmap to mortgage success.

Submitting Your Reapplication

When resubmitting, ensure all documents are accurate and submitted promptly. A larger down payment reduces the overall loan amount, making monthly payments more manageable.

Completing the loan application, providing consistent information, and understanding the underwriting process are essential steps.

Submit Like You Mean Business

A strong reapplication starts with attention to detail.

Every document must tell the same financial story, consistent, accurate, and complete.

Adding more down payment money shows lenders you bring less risk to the table.

The Loan Application: Do It Right This Time

The loan estimate breaks down exactly what you're signing up for:

Principal and interest payments

Estimated property taxes

Insurance costs

Closing fees

Interest rate details

You'll receive this breakdown within three business days after applying.

Closing costs catch many buyers by surprise, they typically run 2-5% of your loan amount and cover things like:

Appraisal fees

Title insurance

Lender fees

Attorney costs

When putting down earnest money (typically 1 to 2% of purchase price), understand it becomes part of your down payment at closing. [source]

Consistency: The Secret Weapon

Inconsistent information triggers red flags. Make sure:

Income numbers match across all documents

Employment history aligns perfectly

Assets and debts appear consistently

My Home Pathway helps organize your application to eliminate these inconsistencies.

Remember to sign everything completely , missing signatures cause needless delays.

Got large deposits in your accounts? Be ready to explain their source with documentation to avoid underwriting delays.

The Underwriting Process: What To Expect

During underwriting, lenders thoroughly examine:

Your credit history

Income stability

Assets and debts

Property details

This typically takes 1 to 3 weeks, depending on complexity.

Don't change jobs, make large purchases, or apply for new credit during this time, these actions can derail your approval.

After underwriting, you'll receive one of three responses:

Approval (green light to close)

Conditional approval (needs specific items addressed)

Denial (with specific reasons provided)

Lenders must provide a written explanation within 30 days if you're denied.

Frequently Asked Questions

What are common reasons for mortgage application denials?

Mortgage applications often get denied due to poor credit scores, a high debt-to-income ratio, limited employment history, or not having enough money for a down payment. Addressing these issues can help boost your chances of approval!

What can help improve your chances of mortgage approval?

Improving your chances of mortgage approval boils down to building your credit by making on time payments, reducing debts, saving for a down payment, and maintaining stable employment. Getting professional guidance can also make a big difference!

What should you do if a home's appraised value is lower than the agreed purchase price?

If the appraisal comes in lower than your purchase price, consider negotiating with the seller to lower the price or increasing your down payment to cover the gap. Either way, it's important to address this issue sooner rather than later to keep your home purchase on track.

What should you do during the mortgage application process to avoid delays?

To avoid delays during the mortgage application process, make sure all forms are signed, clarify any large deposits, and keep your information consistent across all documents. This will help everything go smoothly!

What is the minimum credit score needed to qualify for most FHA loans?

To qualify for most FHA loans, you'll need a minimum credit score of 580. It's a good idea to check your score and see where you stand!

Disclaimer: My Home Pathway is a technology driven risk improvement platform. We are not a mortgage broker or lender and are not representatives of any home loan programs. We are not a credit repair company, HUD certified counseling agency, or one on one home counselor. While we offer mortgage related services, we are not a bank, non profit organization, foundation, or real estate agency. We may partner with those organizations to provide content and access related to our services.

The information provided is for educational purposes only and should not be considered credit repair advice or housing counseling services. For credit repair assistance or housing counseling, please consult with appropriate certified professionals or HUD-approved agencies.

Fintech Founder at My Home Pathway. VC Backed Startup. Financial Inclusion Leader and Speaker.

Risk and project management professional with experience in Federal Reserve banking regulations, risk management policies as well as risk management advisory services. Critical skills include credit risk analysis, capital markets, strategic planning, current state assessments and target operating models. Ability to assess evolving regulatory guidelines and potential impact on financial services organizations operationally and strategically.

Mr. Johnson received his Bachelor of Science in Management and International Business from Penn State University where he was a Bunton Waller Scholar and Division 1 athlete and his MBA in Finance and Accounting from New York University.